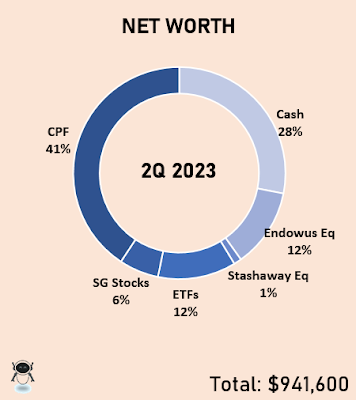

Net worth Update 2Q 2023

CPF: $383,400 (+$7,400)

MA was topped up to BHS at the start of the year, while SA has exceeded FRS due to OA->SA transfer and RSTU over the past few years.

Cash: $264,500 (+$3,800)

Consists of a combination of:

- Cash in UOB One, OCBC360 and DBS Multiplier

- Money market fund in robo cash management

- A small amount in SRS, awaiting allocation into Endowus

ETFs: $113,500 (+$13,400)

Both CSPX and QQQM saw quite a substantial gain this quarter

Endowus: $113,500 (+24,000)

My DCA portfolio for international exposure and tilt toward small cap, value, profitability and momentum. The portfolio consists

- Dimensional US Core Equity (25% of DCA amount)

- Global Core Equity (25%)

- Global Targeted Value (17%)

- Emerging Market Large Cap (8%)

- Pacific Basin (8%)

- Endowus 80% Equity 20% Bond managed portfolio (17%)

SG Stocks: 56,700 (-$4,700)

Individual stocks with focus on dividend-paying companies. Most were purchased during my early foray into investing.

Sold my Raffles Medical at $1.46. Held this stock since 2015, with an XIRR of 2.18% (incl. dividends). Will continue to reduce my exposure to SG stocks whenever I see the opportunity.

Stashaway: $11,000 (+300)

SRI 20% which I brought while experimenting with robo advisors. I no longer inject any fund into it.

Comments

Post a Comment