Making Decisions in an Uncertain World

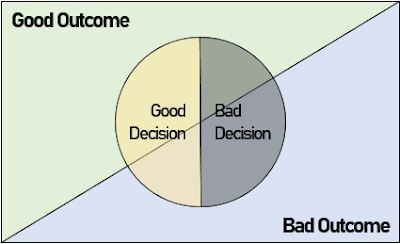

The stock market is unpredictable. No matter how much research you have done, there is always an element of uncertainty involved. Despite this, it is a common tendency for people to evaluate the success of their investment decisions based on outcome of the stock market, even though it is impossible to accurately predict these outcomes at the time of decision making. A bad decision can lead to a good outcome, and vice versa A bad investment decision, such as placing a large bet on a highly risky asset, may result in a good outcome (e.g. scoring a multi-bagger) by sheer luck. However, the investor may overestimate their influence on outcome which may in turn encourage him/her to continue making risky bets. Conversely, a sound investment decision can result in unfavourable outcome. For instance, the decision to invest in a (basket of) low cost broad market index fund/ETF could be a prudent move for long-term wealth growth. However, in the short to middle term, the market return could fal