Singapore's Struggling Stock Market

Singapore is a leading financial centre in Asia-Pacific, ranking third in the 2022 Global Financial Centre Index. This puts it behind only New New York and London, and ahead of our regional rival, Hong Kong. However, despite Singapore's status as a world-class financial hub, its local stock exchange market falls far behind other leading countries in raising capital.

Falling average daily trading volume

One of the most

significant indicators of the health of a stock market is the average

daily trading volume. In Singapore, this has been a steady decline for

more than a decade. For example, the Security Daily Average Volume

(SDAV) of the SG stock market fell from 1.6 billion shares (or $1.3

billion) to 1.1 billion shares (or $0.9 billion) in 2022. The lack of

market participation and the resulting reduced liquidity and lower

market efficiency can lead to a downward spiral of depressed prices and

further reduced trading activity.

Falling number of listed companies over the years

Another concerning trend is the falling number of listed companies in the stock exchange. Between 2012 and 2022, the total number of listed companies fell from 776 to 651. There have been more companies de-listing from the exchange than listing. In 2022 alone, 21 companies have delisted or in the process of delisting, while only 13 companies made their listing debut. Some companies delisted following acquisitions or mergers, while others shifted to other exchanges. This trend suggests that companies are no longer finding the Singapore exchange attractive enough to remain listed or list in the first place.

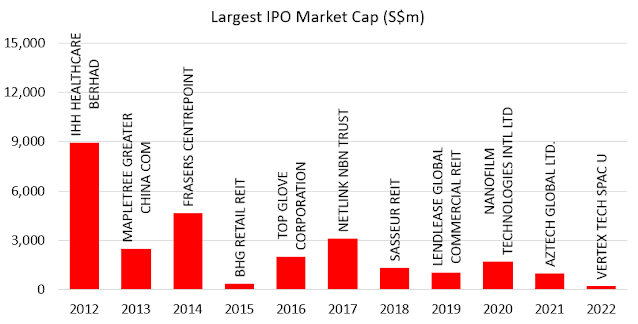

Absence of any major IPO in recent years

Since the Netlink NBN Trust IPO on the SG exchange in 2017, there has not been any major IPO till date. For the whole of 2022, Singapore raised a total of US$428 million from 11 IPO proceeds. In contrast, Malaysia raised US$801 million from 35 IPOs, Indonesia raised US$1.4 billion from 59 listings, and Thailand raised US$3.6 billion from 42 listings.

Successful local companies are listing overseas instead

One of the factors contributing to the lack of major IPOs on the Singapore exchange is that successful local companies are listing overseas instead because of the lack of activity in our local bourse. For example, companies such as Sea Limited and Grab have chosen to list on the New York Stock Exchange and Nasdaq, respectively, rather than the Singapore exchange. Local companies are finding more attractive market conditions overseas, potentially due to larger investor pools or more favourable regulations.

Proliferation of online brokers

With new entrance like Tiger Brokers, Moo Moo, Webull, etc. in recent years, investing in foreign markets has become so much easier and gives Singaporean investors access to biggest and best companies around the world.

Shaken investor confidence

Finally, investor confidence in the Singapore stock market has been shaken by several high-profile incidents over the years.

The CLOB debacle in the 1990s: CLOB stands for Central Limit Order Book, which was formed to provide secondary market to trade Malaysian stocks. Following the Asian Financial Crisis in 1998, Malaysian PM Mahathir accused Singaporeans of subverting the Malaysian economy and banned the trading of CLOB shares without warning. Many Singaporeans were left with Malaysian shares that were worthless or have to sell to Malaysian at steep discount.

The S-chip scandal in the 2000s: S-chips were Chinese companies that had gone public on the SGX in order to raise capital from international investors. At its peak, there were more than a hundred S-chips listed on SGX. However, fraudulent accounting practices started to surface one after another. By the time these issues were made known, many Singaporean investors were already badly burned by S-chips.

The penny stock saga in 2013: The largest market manipulation case in Singapore's history, which sparked a rout that wiped out $8 billion in total market value.

These incidents have put the regulatory environment of the Singapore stock market and its ability to protect investors into question.

Personally, I don't see any light at the end of the tunnel for the Singapore stock market. Falling trading volumes, a declining number of listed companies, the absence of major IPOs, and successful local companies listing overseas are all factors contributing to this decline. Furthermore, investor confidence has been shaken by several high-profile incidents over the years.

Comments

Post a Comment