Making Decisions in an Uncertain World

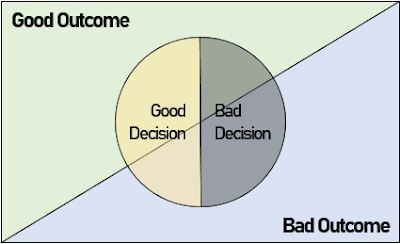

The stock market is inherently unpredictable. Even with detailed research and analysis, uncertainty cannot be eliminated. Yet, many investors still judge the quality of their decisions purely by the eventual outcome, even though that outcome could not have been known at the point of decision. Good Decisions Can Look Bad, and Bad Decisions can Look Good A poor decision (e.g., making an oversized bet on a highly speculative stock) can sometimes result in a strong payoff purely by luck. When this happens, the investor may mistakenly attribute the positive outcome to skill, reinforcing behaviour that is ultimately fragile and unsustainable. Conversely, a sound decision can produce disappointing results. Allocating capital to a broad, low-cost global equity index is supported by decades of evidence and is a rational strategy for long-term wealth accumulation. But in the short to medium term, markets can underperform expectations. If an investor judges their decision solely by these short-te...