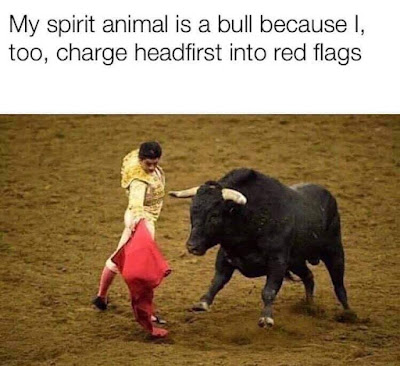

Red Flags: Why I avoid the Chinese Stock Market

Accounting and Transparency Issues

Some Chinese companies may not adhere to the same accounting standards as their counterparts in other countries, making it difficult for investors to assess the true financial position of a company.

For example, in 2020, Luckin Coffee, a Chinese coffee chain, was found to have fabricated sales figures and misled investors. The scandal led to a sharp decline in the company's stock price and a delisting from the NASDAQ stock exchange.

Closer to home, some of the older investors may remember the S-Chip saga in the late 2000s. S-chip refers to a group of Chinese companies that were listed on the Singapore Exchange (SGX) through the use of Special Purpose Acquisition Companies (SPACs). These companies were primarily small and mid-cap Chinese companies that had limited or no track record of profitability. The S-Chip saga came to light in the late 2000s when several S-Chip companies were found to have accounting irregularities and governance issues. These included fraudulent financial reporting, related-party transactions and misappropriation of funds which led to a series of trading suspensions and delisting of S-Chips from the SGX.

Regulatory Risks

China's economy and financial markets are heavily influenced by the Chinese government. Although China has undertaken several market-oriented reforms since the era of Deng Xiaoping, which contributed to the growth of its economy, the current leadership of Xi Jinping has adopted a more interventionist approach towards the economy. Some of these examples include:

- Solar industry: In the early 2010s, China's solar industry experienced rapid growth, fuelled by generous government subsidies and support. However, as the industry matured and global demand slowed, the Chinese government began to withdraw support, leading to a steep decline in the industry. Many solar companies went bankrupt or were forced to merge with larger competitors

- Peer-to-peer (P2P) lending: P2P lending, which match borrowers with individual investors, experienced rapid growth in China in the mid 2010s. However, a series of high-profile scandals and frauds led the Chinese government to crack down on the industry, resulting in many P2P lending platforms going bankrupt

- Gaming industry: The Chinese government imposed stricter regulations on online gaming companies in 2021, particularly on the amount of time minors can spend playing games, citing concerns over the impact of gaming addiction on young people. As a result, shares of major Chinese gaming companies, such as Tencent saw significant declines

- Technology industry: A series of policies aimed at reining in the power of technology companies were implemented in recent years over concerns about the power and influence of large technology companies such as Tencent, Baidu and Alibaba. As a result, technology companies in China face increased scrutiny, regulation and potential penalties

Geopolitical Risks

Investing in the Chinese stock market also carries significant geopolitical risks, particularly with complex relationship between China and the US. The US-China relationship is characterised be a combination of economic interdependence, strategic rivalry and ideological differences.

The US-China trade war, which began in 2018, has been a major source of tension between the two superpowers. The US has imposed tariffs on a wide range of Chinese goods, while China has responded with its tariffs. This has disrupted global supply chains and negatively impacted the performance of some Chinese companies.

The US government also implemented policies and regulations aimed at curbing Chinese investments in the US and limiting the access of Chinese companies to US technology. For example, the US has imposed restrictions on the use of technology from Chinese companies such as Huawei and Tiktok, citing concerns over national security and data privacy. The curb has become more severe in recent months with US limiting Chinese companies from accessing advance semiconductor technology. This could potentially set back the Chinese semiconductor industry by at least 2 decades.

The US and China also have significant ideological differences, with the US criticising China's human rights record, its treatment of ethnic minorities and its actions in Hong Kong and Taiwan. This has led to diplomatic spats and the imposition of sanctions on Chinese officials.

These risks are inherent to investing in the Chinese stock market and require careful considerations by investors. For me, I will continue to avoid the Chinese stock market as long as I do not see any shift in China's interventionist policies and reforms to fix their accounting and governance issues.

The content shared in this post is just my opinion and should not be taken as financial advice. In fact, you should never treat what a random dude shared online as financial advice, no matter how credible they may sound.

Comments

Post a Comment