Investing in the S&P 500? Why CSPX is the Preferred Choice for Singaporean Investors

Among the many S&P 500 ETFs available, I find the iShares Core S&P 500 UCITS ETF (CSPX) stands out as an excellent option for Singaporean investors.

No Estate Duty Tax

One of the most significant advantages of investing in CSPX is that it is not subject to estate duty tax. This is

because it is domiciled in Ireland, which does not have an estate duty

tax. In contrast, US-domiciled ETFs like the SPDR S&P 500 ETF (SPY)

are subject to estate duty tax, which can be as high as 40%, for holdings in excess of US$60,000.

Lower Dividend Withholding Tax (DWT)

Another

advantage of CSPX for Singaporean investors is the lower dividend withholding tax (DWT) rate compared to other S&P

500 ETFs. Dividend withholding tax is a tax levied on dividends paid by US companies to non-US investors. CSPX has lower DWT because Ireland has a tax treaty with the United States that reduces the

DWT rate of the ETF to just 15%. This is significantly lower than the 30% DWT rate for

other S&P 500 ETFs that are domiciled in the US.

Competitive Expense Ratio

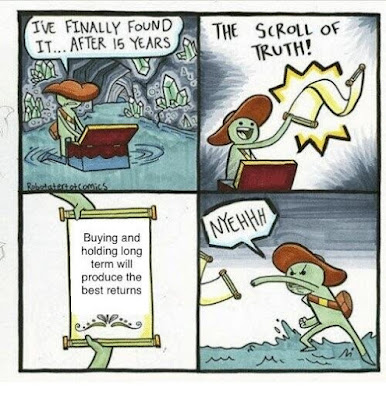

While the expense ratio of CSPX at 0.07% may not be lowest among its competitors, it's important to also take into account the more effective tax treatment that CSPX offers due to its domicile in Ireland. This can make CSPX a more cost-effective option overall, especially for long-term investors.

Accumulating Dividend

CSPX

also has an accumulating dividend distribution policy, which means that

it reinvests any dividends received back into the fund rather than

distributing them to investors. This has the advantage of allowing

investors, especially those in the accumulation phrase of investment, to benefit from compounding without incurring additional

costs. (Note: you are still subjected to 15% DWT even if the dividend is reinvested)

Final Thoughts

In summary, CSPX is a strong choice for Singaporean investors looking to invest in the S&P 500. Its lower DWT, no estate duty tax, and accumulating dividend distribution policy make it a compelling option for investors looking to minimise costs.

The content shared in this post is just my opinion and should not be taken as financial advice. In fact, you should never treat what a random dude shared online as financial advice, no matter how credible he/she may sound.

Comments

Post a Comment